High machine rental analysis in Europe, the United States and China

2024-08-21 17:08High machine rental analysis in Europe, the United States and China

IPAF has released the Global High Aircraft Leasing Market Report 2024. The high-altitude working platform (MEWP) rental market has shown remarkable resilience and growth after the pandemic, with a strong rebound in both Europe and the United States. This article summarily reports and explores the key trends, growth drivers and challenges facing the MEWP rental market in 2024, with comparisons to previous years and forecasts for the near term.

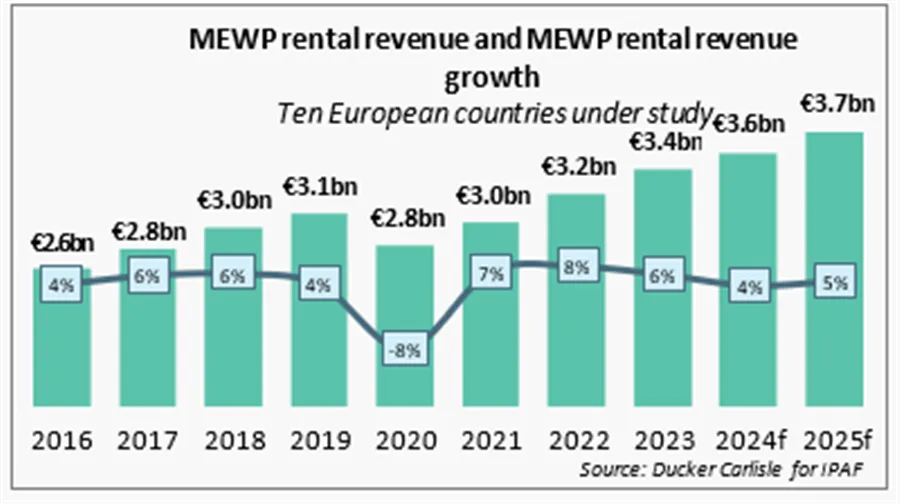

European MEWP rental market

In 2023, the total MEWP rental market in Europe reached €3.4 billion, with most markets experiencing strong growth, particularly in the non-construction sector. The increase was helped by a 4 percent increase in GDP, marking a recovery from the previous year's decline. The GDP outlook for Europe remains positive, with further growth expected in 2024 and 2025. However, the value of construction output in the ten European countries covered in the study declined in 2023, is expected to decline slightly again in 2024, and shows the first signs of recovery in 2025.

By the end of 2023, the European MEWP fleet numbered around 357,000 units. Utilization remained stable, partly due to limited supply of equipment in certain countries and partly due to strong demand. All European countries reported satisfactory utilization rates of more than 60%, indicating a positive and stable market outlook. As lead times for MEWP manufacturers shorten and strong demand for environmentally friendly equipment persists, leasing companies continue to invest in their fleets to catch up with renewal and expansion plans.

France retained its position as the country with the largest MEWP rental fleet, with a fleet size of more than 71,000 vehicles, an increase of around 3,500 vehicles. Germany is next with a fleet size of nearly 64,500 vehicles, while the United Kingdom has nearly 62,000. Spain (10%) and other key markets showed significant growth rates. Average revenue per vehicle increased to 9,597 euros, with Germany maintaining the highest revenue per vehicle.

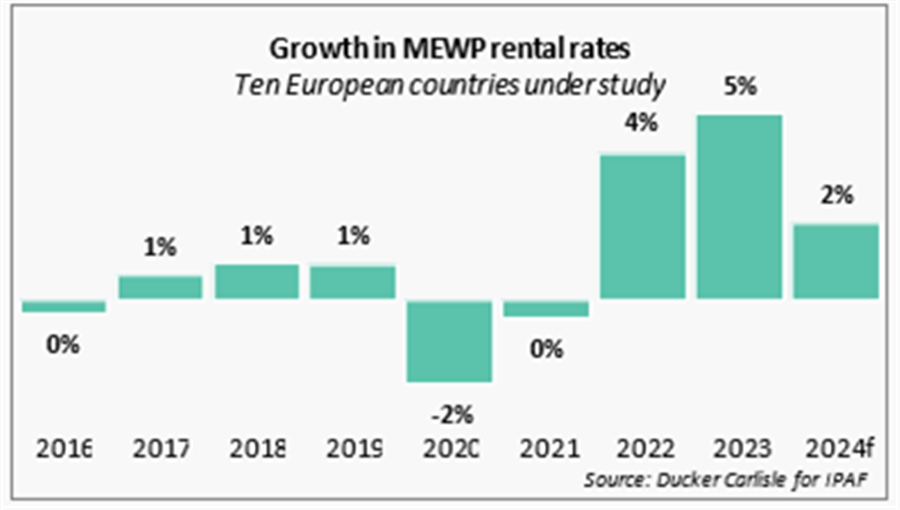

In 2023, investment in fleet renewal and expansion increased by 6% compared to 2022. This investment is driven by high demand and a desire to transition to more environmentally friendly technologies. Due to unprecedented market demand, inflation and rising MEWP purchase prices, leasing companies have been forced to significantly increase rental rates in most European countries, resulting in an increase in average rents. The Nordic region is facing challenges, mainly due to consolidation activities that have increased market competition, thereby restraining rent increases.

The market outlook for 2024 remains positive as manufacturers' delivery times are expected to stabilize further and leasing companies predict that demand will continue to be healthy. However, with inflation in Europe expected to ease, the rate of rental increases should slow, while investment is expected to diminish as rental companies plan to spend more carefully, targeting profits rather than sales volumes.

Us MEWP rental market

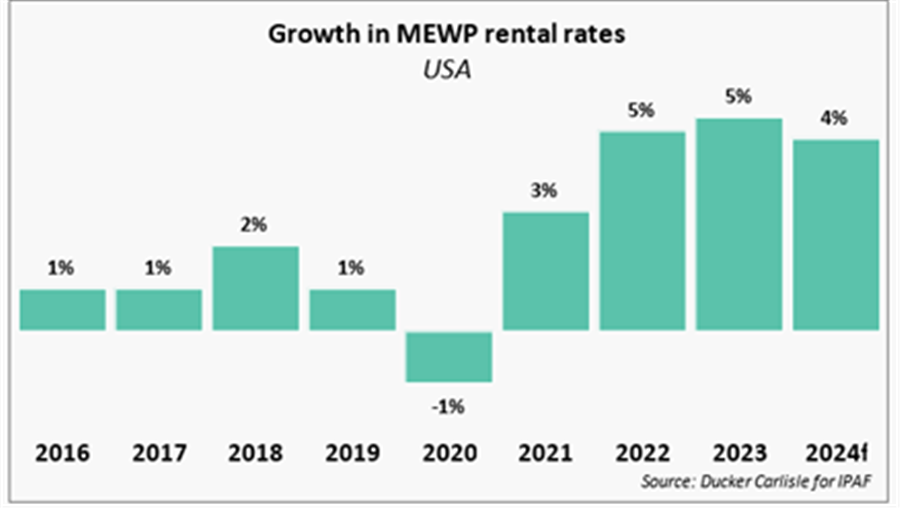

In the United States, the MEWP rental market also saw substantial growth in 2023. After growing 8 percent in 2022, U.S. GDP grew 7 percent in 2023, driven in part by strong performance across all construction sectors. Construction output increased by about $20 billion, leading to strong demand in the MEWP rental market. U.S. MEWP leasing revenue reached a record $15 billion in 2023, up 10 percent. The fleet expanded by 10 per cent to 857,861 vehicles by the end of the year.

The average utilization rate in the United States remains at an all-time high of 73 percent. While delivery times for manufacturers' new equipment have improved, leasing companies have reported that continued levels of demand combined with U.S. tariffs on Chinese equipment have put pressure on utilization. Due to higher investment levels and easing equipment supply, the average age of the fleet in 2023 decreased slightly.

High tariffs imposed on Chinese-made machines continue to restrict the supply of certain models in the market, adding to market pressure. Rent increases by 5% in 2023 to compensate for rising MEWP procurement costs and inflationary pressures. Most companies expect rents to rise further in 2024, albeit at a slower pace, as maintaining customer relationships with high year-over-year growth becomes challenging.

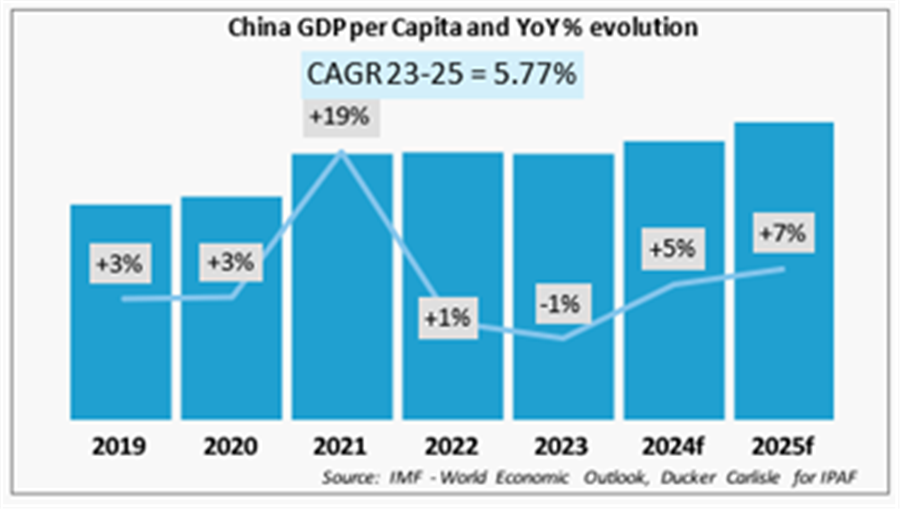

MEWP rental market in China

China's GDP will decline by about 1% in 2023, and the forecast for 2024 is set at about 5%. The macroeconomic outlook for 2024 and 2025 is generally more optimistic than for 2023. Construction activity is expected to remain strong.

In 2023, China's MEWP rental market revenue increased significantly by 19.5% from the previous year. Driven by fleet expansion and improved utilization, leasing revenue reached RMB14.882 billion (€1.946 billion). Nevertheless, rental prices continue to decline due to increased competition, especially in major cities in eastern and Southern China.

The total rental fleet in China has increased to nearly 530,000 units, mainly including shear and fork aerial work vehicles (73.5%) and boom aerial work vehicles (25%). Driven by opportunities in emerging industries such as urbanization, maintenance and renewable energy, the market is expected to grow further in 2024 and 2025. However, leasing companies are expected to be more cautious about fleet expansion due to economic uncertainty.

In 2023, with the relaxation of containment measures and the resumption of downstream projects, the average utilization rate rebounded to 71%. While rents are expected to continue to decline, the rate of decline is expected to slow, with variations in regional rate changes. Overall, the market outlook remains positive, with building safety and efficiency awareness driving stable demand.

Global Trends and Prospects for 2024

Looking ahead, market penetration is calculated using the ratio of MEWP rental fleets to population in each country. The total value of the European MEWP rental market reached €3.4 billion in 2023 and is now well above pre-pandemic levels. Overall market value increased due to higher rental rates and fleet size growth in all countries studied, although inflation also played a role. Three countries still dominate the market, with Germany, the UK and France together accounting for 60% of total market revenue.

The European MEWP rental market continues to shift towards green energy, supported by the increasing supply of new equipment from manufacturers. Electric scissor aerial vehicles dominate fleets in all countries, especially in the Netherlands, Germany and the Nordic countries. The shift to electric scissor aerial vehicles continues in other parts of Europe, but the internal combustion scissor aerial vehicles remain popular in rough terrain and at altitudes of more than 20 meters. Leasing companies report progress by MEWP manufacturers with electrification options and expect an increase in available models in the coming years. The speed of the transition to electric aerial work vehicles varies, depending on national and local needs for rugged terrain equipment, heights above 20 meters, and availability of charging infrastructure.

All in all, the MEWP rental markets in Europe, the United States and China show varying degrees of growth in 2023, driven by high demand, improved rental rates, and investments in fleet expansion and more environmentally friendly technologies. While challenges such as inflation, geopolitical uncertainty and supply chain issues remain, the outlook for 2024 remains positive. The transition to electric MEWP and ongoing technological advancements will continue to shape the future of the global MEWP rental market.