Singapore aerial work platform rental market - Price war, saturation

2024-12-02 15:38Singapore aerial work platform rental market - Price war, saturation

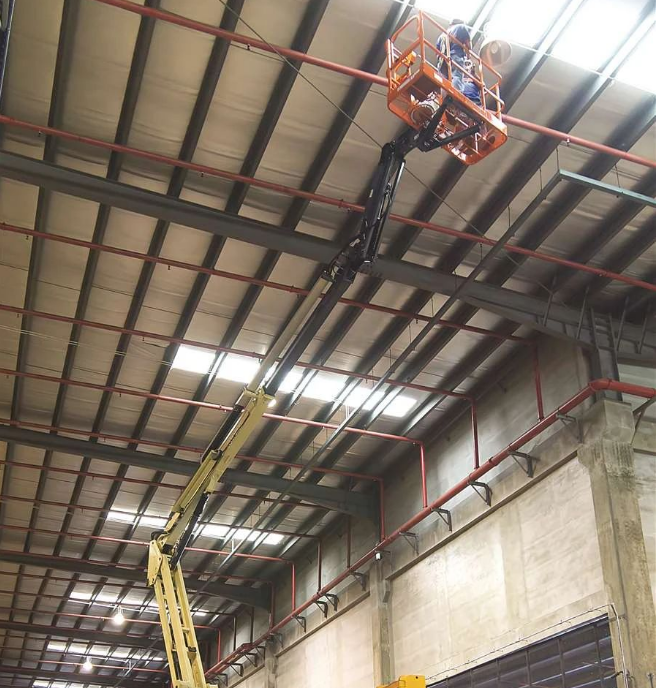

Shawn Ong, chief operating officer of Galmon, Singapore's largest leasing company, discusses how to cope in a sluggish economy and a saturated market. Founded 42 years ago, as a leader in one of the world's most mature aerial work platform (MEWP) markets, Galmon is facing two major challenges - the downturn in the aerial work market and a shortage of labor. Galmon chief operating Officer Shawn Ong noted that the market is "saturated" and locked in a "price war."

Equipment portfolio and competitiveness of Chinese brands In the field of aerial work platforms, Galmon also distributes equipment outside of Singapore. "With the rise of Chinese manufacturers, we started bringing in brands like Dingli and Zoomlion," Ong said. Although JLG is still our main brand, we usually choose Chinese brands when purchasing new equipment because they are lower cost and the Southeast Asian market is very price sensitive - the price war within the region is fierce. We have to use Chinese brands to stay competitive."

Galmon has established a stable sales network in Malaysia and Thailand. Ong said the Thai market was relatively stable with no significant fluctuations, while demand for aeropexing projects in Malaysia declined significantly after the first quarter of this year due to the completion of some large projects such as the Exchange TRX shopping mall in Kuala Lumpur, the renovation of the Merdeka 118 skyscraper, and the Intel project in Penang. Markets in Vietnam and Indonesia have also calmed since the outbreak. Ong pointed out that the company faced some difficulties in selling in Indonesia due to cultural differences. Galmon also sells equipment to Cambodia and Laos in small quantities.

Currently, there are about 11,000 to 12,000 aerial work platforms registered in Singapore, with the number remaining stable over the past 10 years. "We don't see any room for growth in Singapore - it's saturated," Mr Ong admits. In addition, the government stipulates that all aerial work platforms must be registered, which further limits market expansion. There are now about 70 rental companies in Singapore, including major players such as Aver Asia and Modern. However, unlike other Southeast Asian countries, foreign leasing companies have not chosen to enter the Singapore market due to the lack of growth potential. In contrast, Malaysia has greater market growth potential due to more investment attracted by infrastructure projects such as data centers and MRT projects.

Labour shortages and technological transformation Ong said the Labour problem has become more serious after the pandemic. Government restrictions on foreign workers have reduced the workforce by 15%. Although Galmon is trying to reduce its reliance on humans through the Internet of Things (IoT) and remote monitoring technology, this only solves about 20 percent of the problems and 80 percent of the requirements still need to be completed by humans. This directly leads to extended equipment repair turnaround times and increased customer wait times.

Singapore's economic performance in 2024 is down from 2023, with the market focusing on three major projects: the Resorts World Sentosa Casino expansion, the Marina Bay Casino expansion, and the Changi Airport Terminal 5 project. However, the demand for aerial work platforms for these projects is not expected to emerge until the second half of 2025. Currently, Galmon's equipment utilization rate is 60%, down from the normal 80%. Rental prices have also fallen sharply, with the monthly rent for a 6-metre clip-fork aerial work platform, for example, dropping to S $300, half of what it was last year.

Equipment Purchasing & Market Trends Approximately 30% of Galmon's equipment is purchased new each year and the rest is used. In the past three to four years, the proportion of Western branded equipment purchases has fallen from 100 per cent to 60-70 per cent, but in used equipment purchases, Western brands such as JLG and Genie still dominate. A significant trend in the market is the growing demand for large shear and arm aerial work platforms, especially electric equipment. "As the market matures, the demand for smaller devices is decreasing, while the demand for larger, more flexible devices is increasing," Mr Ong said. Currently, Galmon's largest arm-type aerial work platform is 28 meters, and the shear fork platform is 18 meters, and the company plans to invest in more large-scale equipment in the future. In the field of special equipment, such as spider aerial work platform, the market demand has been low. Galmon currently rents just five Spider platforms in Singapore, and that number is not expected to grow.