IPAF 2024 Global Leasing Market Report

2024-06-26 18:01IPAF 2024 Global Leasing Market Report

In 2023, the leasing rate of MEWP in European countries will exceed 60%

The mobile lift work platform (MEWP) rental market in Europe, the United States and China saw varying degrees of growth in 2010, driven by strong demand, higher rental rates, and investments in fleet expansion and green technologies. Despite persistent challenges such as inflation, geopolitical uncertainty and supply chain issues, the outlook for 2024 is generally positive.

The recently released IPAF 2024 Global Rental Market Report delves into these markets, estimating the size of the global MEWP rental fleet and providing metrics such as rental revenue and rates, fleet size, utilization, fleet mix, machine power, investment, annual retention period, and analyzing and comparing the relevant data by country, region, and machine type

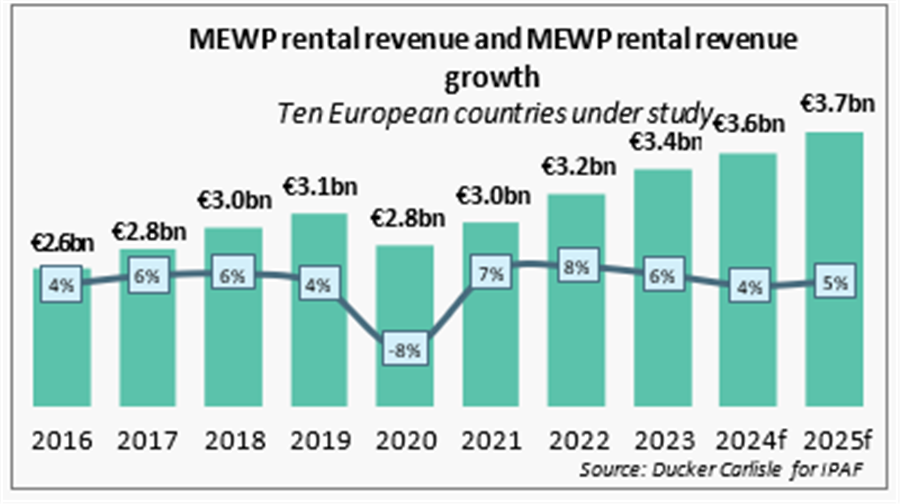

In 2023, the total MEWP rental market in Europe reached €3.4 billion, with most markets experiencing strong growth, especially in the non-construction sector.

The increase was helped by a 4 percent increase in GDP, marking a recovery from the previous year's decline. The GDP outlook for Europe remains positive, with further growth expected in 2024 and 2025.

However, construction production in the 10 European countries studied declined in 2023 and is expected to decline slightly again in 2024 before showing the first signs of recovery in 2025.

By the end of 2023, the European MEWP fleet will number around 357,000 vehicles. Utilization remained stable, partly due to limited supply of equipment in certain countries and partly due to strong demand.

Occupancy rates in all European countries reached satisfactory levels of more than 60%, indicating a positive and stable market outlook.

As lead times for MEWP manufacturers shorten and strong demand for environmentally friendly equipment persists, leasing companies continue to invest in their fleets to catch up with renewal and expansion plans.

France retained its position as the country with the largest MEWP rental fleet, adding about 3,500 units to more than 71,000. Despite the strength of the team, France has struggled in terms of construction.

Germany is next with a fleet size of nearly 64,500, while the United Kingdom has nearly 62,000.

Spain (10%) and other key markets showed significant growth, with average unit revenue increasing to €9,597, with Germany maintaining the highest unit revenue.

In 2023, investment in fleet renewal and expansion increased by 6% compared to 2022. This investment is driven by high demand and a desire to transition to more environmentally friendly technologies.

Due to unprecedented market demand, rising inflation and MEWP purchase prices, leasing companies have been forced to significantly increase rents in most European countries. The Nordic region in particular is facing challenges, mainly because consolidation activities have increased competition in the market, thereby restraining rent increases.

The market outlook for 2024 remains positive as manufacturers' delivery times are expected to stabilize further and leasing companies predict that demand will continue to be healthy. However, with inflation in Europe expected to ease, rental increases should slow, while investment is expected to diminish, and leasing companies plan to spend more carefully, targeting profit margins rather than volume.